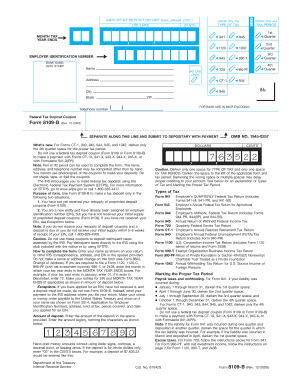

IRS 5305-SIMPLE 2012-2025 free printable template

Show details

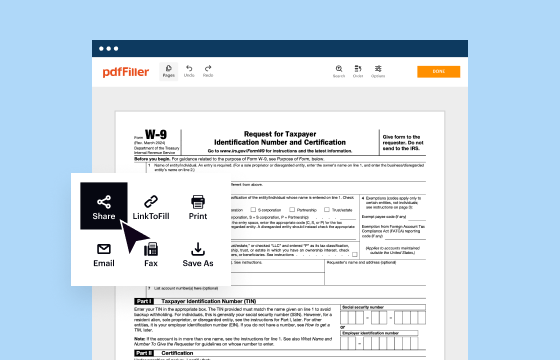

The Internal Revenue Bulletin, and on the IRS×39’s internet website at IRS.gov. .... the IRS. Instead, keep it with your records. For more information, see Pub. 560,

pdfFiller is not affiliated with IRS

Understanding and Utilizing IRS Form 5305-SIMPLE

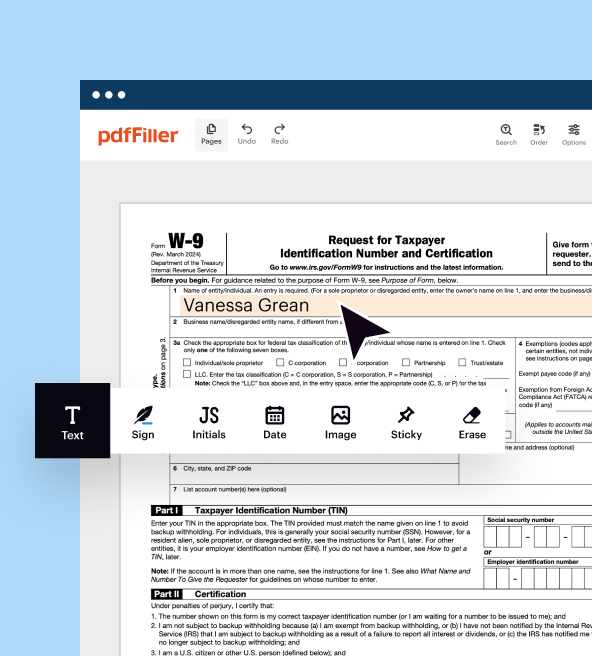

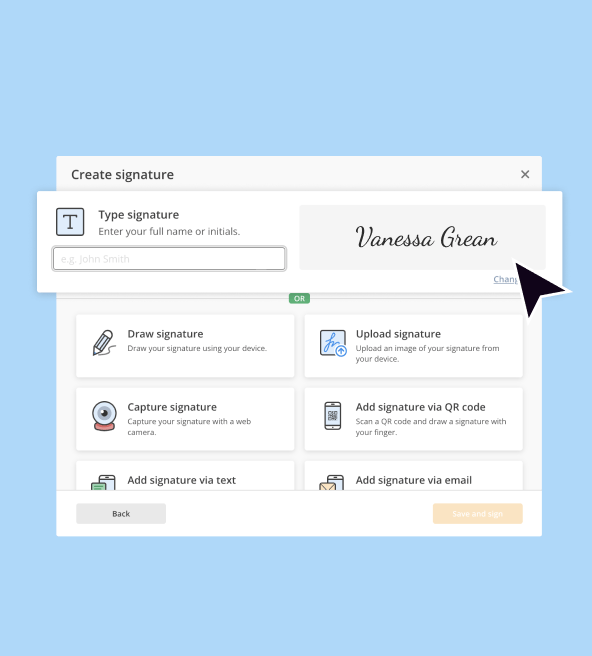

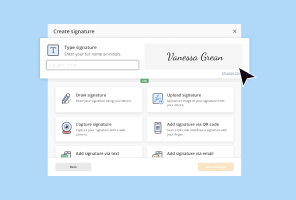

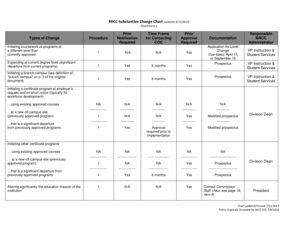

Comprehensive Guide for Form Modification

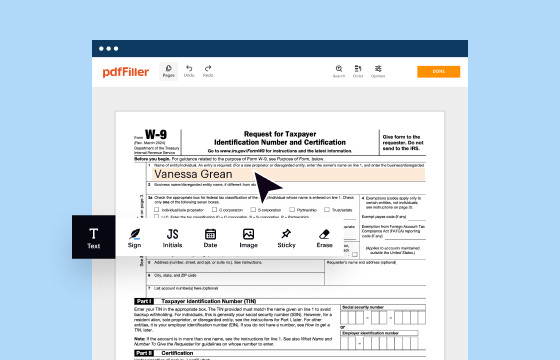

Steps for Accurate Form Completion

Understanding and Utilizing IRS Form 5305-SIMPLE

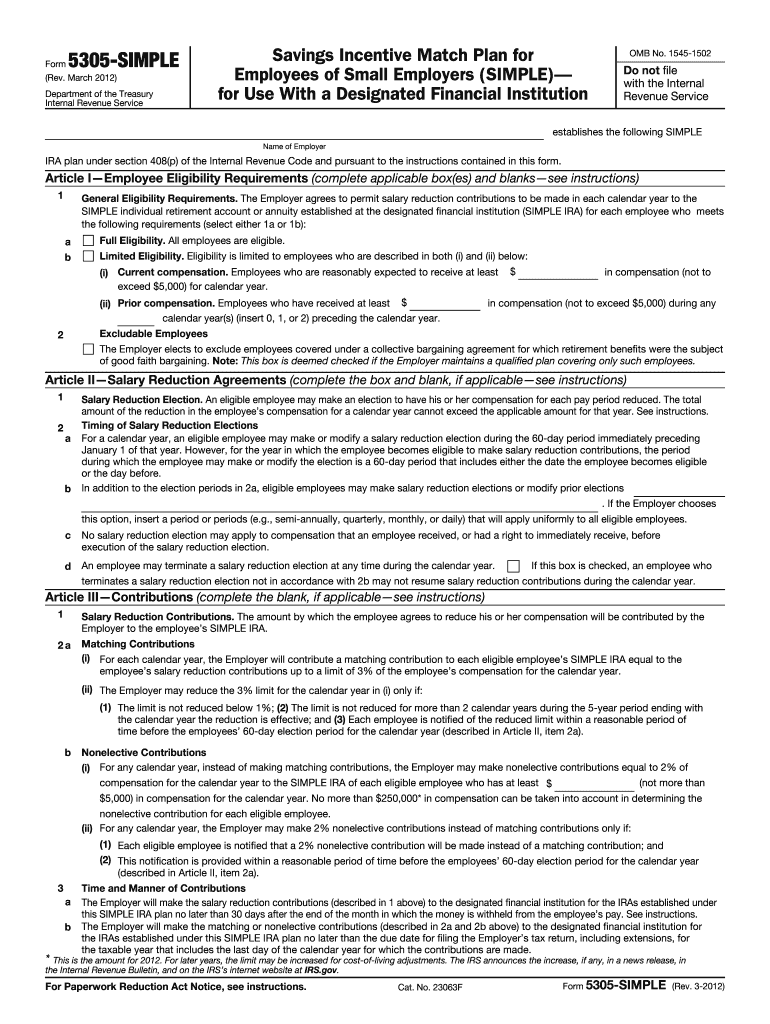

IRS Form 5305-SIMPLE is essential for small business owners looking to establish a Savings Incentive Match Plan for Employees (SIMPLE) IRA. This form enables employers to facilitate tax-deferred retirement savings for their employees while enjoying significant tax advantages. Understanding this form and its implications is crucial for compliance and effective retirement planning.

Comprehensive Guide for Form Modification

To effectively modify your IRS 5305-SIMPLE form, follow these outlined steps:

01

Review the current version of IRS Form 5305-SIMPLE to familiarize yourself with its sections.

02

Determine which specific details require changes, such as employer information or plan year dates.

03

Utilize the updated IRS guidelines to make necessary adjustments to the form.

04

Consult with a tax professional if uncertainties arise regarding changes in regulatory compliance.

05

Keep a record of all modifications for future reference and documentation purposes.

Steps for Accurate Form Completion

To complete IRS Form 5305-SIMPLE accurately, adhere to this process:

01

Begin by providing the employer's name, address, and Employer Identification Number (EIN).

02

Detail the plan information, including the plan name and the effective date.

03

Specify the eligibility criteria for employees who may participate in the plan.

04

Indicate the employer contribution structure, including any matching contributions.

05

Review the completed form for accuracy before submission.

Show more

Show less

Recent Developments Concerning IRS 5305-SIMPLE

Recent Developments Concerning IRS 5305-SIMPLE

The IRS frequently updates guidelines that impact the filing and compliance aspects of Form 5305-SIMPLE. Recent changes include adjusted contribution limits, specific rules for rollovers, and modifications in eligibility criteria that reflect shifts in tax regulations. It's vital for employers to stay abreast of these changes to ensure compliance.

Key Insights into IRS Form 5305-SIMPLE

Defining IRS Form 5305-SIMPLE

Purpose Behind IRS Form 5305-SIMPLE

Who Needs to Fill Out This Form?

Criteria for Exemption from Filing

Core Elements of IRS Form 5305-SIMPLE

Filing Deadline for IRS Form 5305-SIMPLE

Comparison with Similar Forms

Transactions Covered by the Form

Copies Required for Submission

Penalties for Non-Submission of IRS Form 5305-SIMPLE

Information Needed to File IRS Form 5305-SIMPLE

Other Forms Accompanying IRS Form 5305-SIMPLE

Submission Address for IRS Form 5305-SIMPLE

Key Insights into IRS Form 5305-SIMPLE

Defining IRS Form 5305-SIMPLE

IRS Form 5305-SIMPLE is utilized by small businesses to set up a SIMPLE IRA plan. This plan allows employees to save for retirement while providing a means for employers to offer matching contributions. The application of this form not only promotes retirement savings but also enhances employee benefits.

Purpose Behind IRS Form 5305-SIMPLE

The primary purpose of IRS 5305-SIMPLE is to facilitate the creation of a SIMPLE IRA plan, making it easier for small businesses to offer retirement savings options. This form encourages employee participation in retirement planning through tax-deferred contributions, thus fostering long-term financial security.

Who Needs to Fill Out This Form?

Employers with 100 or fewer employees who earned at least $5,000 in compensation during the preceding year are typically required to complete IRS 5305-SIMPLE. Additionally, any business that wishes to structure a SIMPLE IRA plan must utilize this form as part of their establishment process.

Criteria for Exemption from Filing

The following conditions may result in exemptions from filing IRS Form 5305-SIMPLE:

01

Employers with more than 100 employees who are eligible to participate in the plan.

02

Businesses that do not comply with the SIMPLE IRA regulations due to lack of participation or employer contributions.

03

Employers who have previously established a different retirement plan within the specified timeframe.

Core Elements of IRS Form 5305-SIMPLE

The basic components of the form include:

01

Employer details, including name and address.

02

Plan year and effective date.

03

Eligibility rules for employee participation.

04

Specifics on employer matching contributions or any flat dollar contributions.

Filing Deadline for IRS Form 5305-SIMPLE

The deadline for submitting Form 5305-SIMPLE is the tax filing date for the employer, usually April 15 of the following year. It is critical to ensure that the form is filed on time to avoid penalties and ensure the allotted tax benefits remain available.

Comparison with Similar Forms

When compared to IRS Form 5500, which is used for annual reporting of employee benefit plans, IRS Form 5305-SIMPLE is streamlined, specifically designed for employers looking to establish SIMPLE IRAs without the complex reporting requirements. While both aim to facilitate employee savings, the filing processes and requirements differ significantly.

Transactions Covered by the Form

01

Initial establishment of the SIMPLE IRA plan.

02

Employee contributions, which can be made through salary deferrals.

03

Employer matching or nonelective contributions specified in the plan.

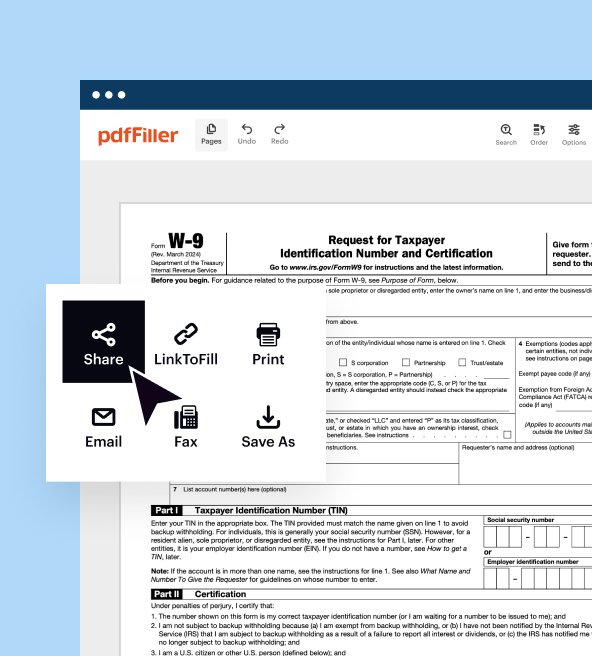

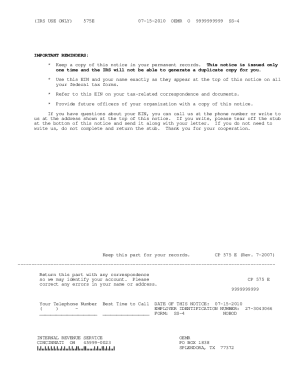

Copies Required for Submission

Employers are required to keep at least one copy of the completed IRS Form 5305-SIMPLE on file. It is advisable to retain additional copies for each employee for record-keeping purposes, ensuring transparency and compliance during audits or reviews.

Penalties for Non-Submission of IRS Form 5305-SIMPLE

Failure to submit Form 5305-SIMPLE can result in various penalties, including:

01

Financial penalties that may vary based on the severity and frequency of non-compliance.

02

Loss of tax-deferred retirement savings benefits for both employees and employers.

03

Potential legal actions if the non-compliance significantly impacts employee retirement funds.

Information Needed to File IRS Form 5305-SIMPLE

The following information is crucial for filing:

01

Employer name and Employer Identification Number (EIN).

02

Details about the plan including plan year, eligibility criteria, and contributions.

03

Employee information regarding participation.

Other Forms Accompanying IRS Form 5305-SIMPLE

In certain situations, employers may need to include other forms such as IRS Form 8880 (Credit for Qualified Retirement Savings Contributions) to claim any eligible tax credits alongside the SIMPLE IRA plan setup.

Submission Address for IRS Form 5305-SIMPLE

Completed IRS Form 5305-SIMPLE should be sent to the appropriate IRS address based on where the employer’s principal place of business is located. For most employers, this is the IRS address pertinent to employment tax matters listed on the IRS website.

Understanding and correctly utilizing IRS Form 5305-SIMPLE is vital for both compliance and the facilitation of effective retirement plans within small businesses. For any inquiries or assistance in form completion, consider reaching out to tax professionals or consulting the IRS resources directly to ensure a smooth filing process.

Show more

Show less

Try Risk Free