IRS 5305-SIMPLE 2012-2026 free printable template

Instructions and Help about IRS 5305-SIMPLE

How to edit IRS 5305-SIMPLE

How to fill out IRS 5305-SIMPLE

Latest updates to IRS 5305-SIMPLE

All You Need to Know About IRS 5305-SIMPLE

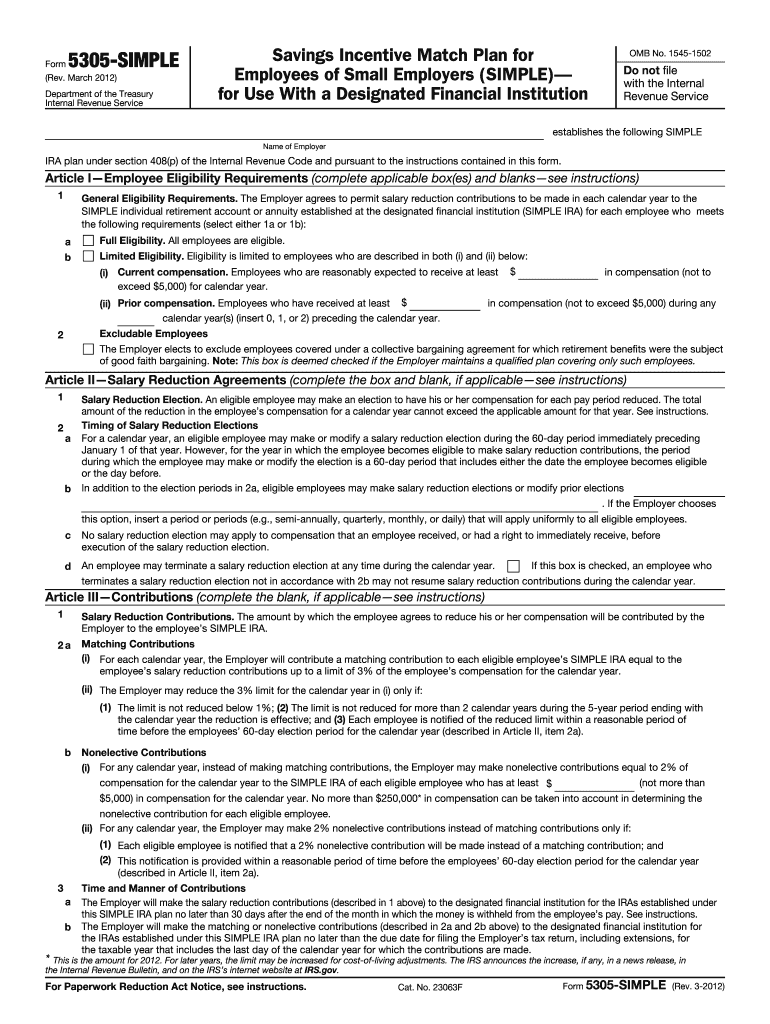

What is IRS 5305-SIMPLE?

Who needs the form?

Components of the form

What information do you need when you file the form?

What is the purpose of this form?

When am I exempt from filling out this form?

What are the penalties for not issuing the form?

Is the form accompanied by other forms?

Where do I send the form?

FAQ about IRS 5305-SIMPLE

What should I do if I find an error in my submitted IRS 5305-SIMPLE?

If you discover an error after submitting your IRS 5305-SIMPLE, you need to correct it by filing an amended version. Ensure that you clearly indicate the changes made and retain a copy for your records. It's important to verify that the corrected form is accepted by the IRS to avoid any potential issues.

How can I verify the status of my IRS 5305-SIMPLE submission?

To verify the status of your IRS 5305-SIMPLE submission, you can check the IRS e-file status tool or call the IRS directly. If you encounter common e-file rejection codes, follow the accompanying guidance to resolve the issues promptly and ensure successful processing of your form.

Are there any legal considerations for e-signatures on the IRS 5305-SIMPLE?

E-signatures are generally acceptable for the IRS 5305-SIMPLE, but you should ensure compliance with IRS regulations regarding electronic signatures. Retain records of the e-signed document as part of your file to maintain legal proof of submission.

What should I do if I receive a notice from the IRS regarding my IRS 5305-SIMPLE?

Upon receiving an IRS notice about your IRS 5305-SIMPLE, carefully review the correspondence to understand the issue. Prepare any necessary documentation and respond promptly according to the instructions in the notice to address the matter effectively.

What common errors should I avoid when filing IRS 5305-SIMPLE?

To prevent common errors when filing the IRS 5305-SIMPLE, double-check the information you enter for accuracy and consistency. Ensure that you've selected the correct filing status and avoid skipping mandatory sections to minimize the risk of rejection and delays.